As a loan officer, your phone never leaves your side. You can instantly check your applicant’s credit score by pulling out your phone, rather than heading to a library or computer. You can also check your competition to see what applications they’ve submitted and how many loans they’ve processed. In this guide, I’ll cover the 10 best Android apps for loan officers in detail and make suggestions on how to use them.

Table of Contents

Best Apps For Loan Officers

ADVERTISEMENT

Beautiful invoicing software.

[Latest!] Top 7 Mobile Loan Apps For Online Lending In Nigeria

online loans mobile apps nigeria

164

SHARES

Share

Tweet

Subscribe

Most often, many individuals and business owners might need some extra-cash to in handling some financial issues around them. In times like this when all means of getting money has been exhausted, the best alternative is to consider getting a quick and easily affordable loan online.

The process of accessing quick loans in Nigerian banks is quite lengthy and tedious for any individual that is only looking to access a small amount of loan for only a short period of time.

Thanks to the Fintech revolution in Nigeria, online lending startups are making it easy for businesses and individuals to have access to quick loans when needs. Here is a list of top 7 mobile apps for online busines and personal loans in Nigeria.

- Paylater

Paylater is an easy-to-use and entirely online lending platform that provides short-term loans to individuals and small businesses in Nigeria to help cover unexpected expenses or urgent cash needs.

With Paylater, you can access up to 500,000 Naira loan with no collateral. Once your application is approved, funds are typically received within 1 – 3 business days. Making on-time repayments can grant you access to higher credit limits for your next loan.

Download the Paylater App to get quick and flexible loans at affordable rates.

paylater nigeria website

Also Read: 7 Top Business Grants & Loans Available for Small Businesses in Nigeria.

- Palmcredit

PalmCredit is a virtual credit card that makes it easy for you to access a loan anytime and anywhere. Palmcredit offers loans of up to ₦100,000 within minutes on your mobile phone.

With PalmCredit getting a mobile loan is simple. Apply for your credit limit in minutes, then take as many instant loans as you need without further approval steps. It’s a credit revolution!

As soon as you repay, your credit score is updated. Repay on time and watch your limit grow to N100,000.

Download the Palmcredit App to get instant and flexible loans at affordable rates.

palmcredit app nigeria

- Branch

Branch is a simple yet powerful mobile loan app in Nigeria and Kenya. Getting quick and instant loans on Branch App is so fast and easy. It will help you sort out your financial issues in real time.

Branch offers loans from ₦1,500 to ₦150,000. Loan terms range from 4 – 64 weeks. Interest ranges from 14% – 28% with an equivalent monthly interest of 1% – 21%, depending on selected loan option.

Download Branch App for access to quick and instant loans.

branch app nigeria

Also Read: 10 Small Businesses That Make The Most Millions In Nigeria.

- QuickCheck

QuickCheck is a modern lending platform for individuals and small businesses. QuickCheck uses mobile technology to enable individuals and small businesses to gain access to financial credit.

According to the platform, users can access quick and hassle-free loans of up to 30,000 Naira without any collateral for a duration of either 15 or 30 days.

You can get the QuickCheck App on Google Playstore.

quickcheck nigeria website

- Aella Credit

Aella Credit is building platforms that make it easier for individuals in Africa to gain access to financing. Mainly focused on employee lending and empowerment, the company was affiliated with three main credit bureau agencies in Nigeria to provide quick and affordable loans with no paperwork to its customers.

Aella Credit uses a proprietary credit scoring algorithm to determine the creditworthiness of its users. The algorithm, which was built after the team gathered over five years of market data and analysis, processes an applicant’s eligibility for a loan by considering social and demographic factors as well as their debt to income ratio.

Download Aella Credit App now to get started.

aellacredit nigeria website

Also Read: Five ways to get funds for a startup business in Nigeria.

- FairMoney

FairMoney offers short-term loans to help cover for urgent needs, bills, business and much more. They give access to loans at any time and anywhere with our loan application within 5 minutes.

FairMoney packages include personal loan, education loan, business loan & more. With the effective use of technology, they are able to provide a speedy and efficient loan app to all our esteemed customers.

fairmoney loan app nigeria

- KiaKia

KiaKia is a mobile web app that gives you access to personal and small business loans and also enables savers to lend out funds at negotiated interests through intuitive conversations.

KiaKia utilizes psychometry, big-data, machine learning and digital forensics for its proprietary credit scoring and credit risk assessment algorithm to provide direct and peered personal and business loans to millions of individuals and SMEs without credit information.

loan officer tools

1) Professional Mortgage Loan Officer Website

Let’s start with one of the most basic yet important lead generation tools you can have: a website. Not only does having your own website increase your credibility among clients, it can be a great marketing tool that advertises all of the information a prospective client or Broker may be seeking. If you don’t have a website yet, make it a top priority; we’re living in a digital age, and not having a website is akin to not having a business address. If you have a website, consider if it’s up to date and truly representative of your expertise.

Your website should outline:

The services you offer

Your contact information

Your brokerage

Your niche (as applicable)

Your professional achievements

Why you chose to join the mortgage industry

How long you’ve been a part of the industry

Need help in creating your website? These platforms are built to make website creation simple and straightforward:

Squarespace is a website builder and hosting service that allows you to use ready-made templates to create your own website. They provide you with a custom domain, eCommerce capabilities, analytics, social media/SEO tools, and around-the-clock support.

Wix is a web development service that provides you with a website builder chock-full of templates and designs so you can build a website personalized to your taste. They also offer online scheduling software, a logo maker, custom domains, and SEO tools to help boost your business.

2) CRM

CRMs, or customer relationship management software, allow you to manage your client relationships and interactions through a carefully organized database. The relationships you forge are critical in terms of finding success in the mortgage industry, so it’s crucial that you focus on engaging your prospective, current, and former clients to generate business.

To that end, you likely spend a significant amount of time approving documents and taking client phone calls. Work smarter, not harder, by letting a CRM keep track of details like your last interaction with a customer, their loan information, and their contact information so that you can focus on what’s really important: serving your clients.

If you’re ready to build your own powerhouse database with the help of a CRM, check out these options:

Surefire CRM can help you gain new business while keeping up with your current clientele. This tool utilizes set-it-and-forget-it workflows while offering you free resources to help maintain and grow your relationships with borrowers, recruits, members, Brokers, and real estate agents.

Keap organizes your client information and daily tasks to free up time in your schedule. You’re able to track invoices, schedule emails, implement marketing plans, get quotes to your clients quickly, and store all of that information in one place.

Tech Tools for Mortgage Loan Officers

3) Loan Origination System (LOS)

The two main functions of a loan origination system are the origination and fulfillment of a loan. An LOS will pull together the staff involved with the loan origination, including Loan Officers, underwriters, and processors. This system will track and drive borrowers through the stages of the origination process, including pre-qualification, pre-approval, loan application, processing, underwriting, credit decision, quality control, and funding. Newer loan origination systems not only make your day-to-day simpler, but they often feature fraud detection, data security, automated decision-making, and compliance-related reporting and tools.

A successful LOS will need to be able to integrate with your CRM, so be sure to seek out systems that are compatible.

To find an LOS that fits the needs of your business, we recommend checking out the following options:

Empower is an LOS that utilizes AI, digital loan applications and closings, analytics, and an extensive network of third-party service providers to help you work more efficiently while lowering operational costs and giving your clients a streamlined experience. Empower can be integrated with the Surefire CRM.

Encompass is a customizable LOS that grows along with your business. Offering document management, digital signing, compliance checks, and integration with many popular CRMs, Encompass is an all-in-one system that can help you originate more loans and close in less time.

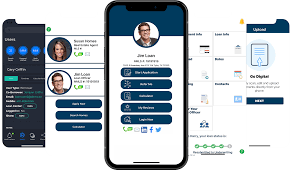

4) Point-of-Sale (POS) Software

Consumers have come to expect the ease of having access to everything they need through the internet, so why not make their application process more straightforward by supplying your own point-of-sale system? Give your clients the option to avoid any extra calls and appointments that can be handled through a digital service.

Here are two POS software tools that you can integrate into your CRM and LOS:

Floify helps you collect all documentation you’ll need from your clients in a centralized location, making the process transparent and efficient for you and your clients alike. Available on desktop or mobile devices, Floify lets you customize your workflows, organize uploaded documents, and offers internal audit features, creating an interactive way to lead a client through the mortgage process.

SimpleNexus works to unite the people, systems, and stages of the mortgage process into one streamlined solution. Clients can safely upload all of their documents, keep track of where they are in the loan process, and even use the payment calculator to play with different pricing options.

5) Lead Generation Services

As a Mortgage Loan Officer, you know how important lead generation is. It brings you new clients to serve and overall boosts your business when executed correctly! That’s why lead generation should be top of mind when you’re formulating your marketing strategy. Luckily, there are tools that can help you take your lead generation efforts to the next level, including:

ProspectNow gives you access to nationwide property data and analytics, seller predictions, and AI capabilities to expand your network. You’re able to generate leads without having to manually reach out.

Leadpress works with your website to help convert prospective clients into lifetime customers. This software utilizes lead capture forms, optimized landing pages, SEO tools, and an analytics dashboard to help you turn your website into a lead generation tool.

Do not discount the value that technology can add to your mortgage business. Not only are these tools going to help with your marketing efforts, but they will make the mortgage industry that much more accessible for your clients. If you don’t implement any of these practices, you’ll soon be left in the dust by those capitalizing on these impressive pieces of tech.

Conclusion

Let us know your thoughts in the comment section below.

Check out other publications to gain access to more digital resources if you are just starting out with Flux Resource.

Also contact us today to optimize your business(s)/Brand(s) for Search Engines