Accounting software is a must-have tool for small and midsize businesses these days.

It streamlines how businesses manage their finances, making the process easier and more efficient.

If you’re looking for accounting software but don’t have a big budget to work with, there are plenty of free options available to you.

So what are the best free online accounting software for businesses? We’ve rounded up our top picks below!

We’ve rounded up our top picks below!

Best Free Online Accounting Software For Small Business

Free accounting software might seem like a myth—in fact, many business accounting software options that say they’re free end up charging you in some form or fashion, whether they require you to upgrade for some crucial feature or require that you pay for installation.

While searching for free software for your small business, be sure to know exactly what costs each option could potentially entail. We’ve compiled some of the best accounting software options that are actually free. Of course, most of these options will include versions and add-ons that will cost you, but their most basic versions are completely free:

1. Wave

A top free accounting software to consider from the start of your search is Wave accounting software. Through this option, you’ll be able to connect unlimited bank and credit card accounts to your books. You’ll also be able to add unlimited income tracking, expense tracking, and guest collaborators for free. Plus, you’ll be able to invoice and scan receipts for free as well.

Be sure to note, though: If you want your invoiced customers to be able to pay online directly through the invoice, you’ll need to pay for that. Wave charges 2.9% + $0.30 for each credit card payment and 1% (with a minimum of $1) for each ACH payment. You’ll also need to pay for payroll through Wave. Depending on where you do business, you’ll pay a monthly base fee of either $35 or $20, plus $4 per employee and contractor on your payroll.

2. ZipBooks

Another top free accounting software for small businesses to consider is ZipBooks. ZipBooks offers all the crucial features of an accounting software—reports, bank syncing, billing, expense management, and invoicing—in one free account.

If you want to offer online payments to your invoiced customers via ZipBooks, you’ll need to do so via Square or PayPal. You’ll pay the standard PayPal rates and Square rates for those transactions.

ZipBooks offers an integrated payroll add-on option with Gusto. Gusto starts at $39 per month, plus $6 per person per month. For a limited time, you can get the Core plan for a discounted price of a monthly $19 base cost for the first six months. Gusto also has a new option for contractor-only employers, who simply pay the $6 per employee rate and no base price.

3. Akaunting

You should also consider a free accounting software called Akaunting. This option offers many of the most necessary features that a small business accounting software should. Within this technology, you’ll be able to invoice, sync accounts, track expenses, set up recurring bills, manage customers, and manage vendors. However, to access more advanced features like online payments, for example, you’ll have to download third-party apps that will cost you a yearly fee on top of whatever fees you have to pay for this third-party account.

Long story short, creating an Akaunting account won’t cost you anything, but as you navigate this software, you’ll realize that all the capabilities that you might expect to be ready-to-use will rely on your purchasing these third-party apps.

4. SlickPie

The free accounting software SlickPie is also worth looking into for your small business finances. The free version of this accounting software allows for unlimited automated receipt entries, 10 different companies on one account, and email support. It also allows you to create quotes and estimates that can easily become professional invoices. SlickPie also allows you to connect your PayPal and Stripe accounts for free. That means customers will be able to fulfill their invoices with card or PayPal payments online—and you’ll simply have to pay the standard transaction fees that PayPal and Stripe charge.

One feature that this free accounting software seems to be lacking is reports—the SlickPie website doesn’t highlight any built-in reporting capabilities. If you’re hoping to extract valuable, high-level insights from your accounting software, then you might want to consider options other than SlickPie.

5. GnuCash

If you’re looking for a free desktop accounting software for your small business, then GnuCash is a solid contender. To access this free accounting software option, all you have to do is go to the GnuCash site and download it for free—simple as that. Though GnuCash doubles as a personal and small business accounting software, it offers small business-specific features customer and vendor tracking, job costing, and invoicing.

6. CloudBooks

With the free version of CloudBooks accounting software, you’ll be able to add unlimited users, invoice, create projects, perform integrated time tracking, track expenses, and provide estimates. That said, you’ll have to upgrade from the free version—and pay at least $10 a month—to be able to send more than five invoices per month, brand your invoices, and offer online payments on your invoices.

7. Zoho Invoice

If you’re looking for the best free accounting software to automate your invoicing workflows, then Zoho Invoice will be a top option. With the free version of Zoho Invoice, you’ll be able to invoice customers and manage payments through a single account. You’ll also be able to customize and brand invoice templates, track expenses, and interact with customers through a client portal. Not to mention, you can run integrated time tracking for yourself and employees for project billing.Sign Up for Zoho Invoice for Free

8. NCH Express Accounts

Another free desktop accounting software option to consider is NCH Express Accounts. The free version of this accounting software can support the accounting needs of small businesses with fewer than five employees. Through this free accounting software for small businesses, you’ll be able to access and generate 20 crucial financial reports and analyze revenues by customer, team member, or item. You’ll also be able to manage accounts receivable and payable easily through this software. That said, in order to access your books online, you’ll have to purchase the cloud version of Express Accounts, which isn’t free and currently starts at $59.95.See Top Accounting Software Options

top 10 accounting software

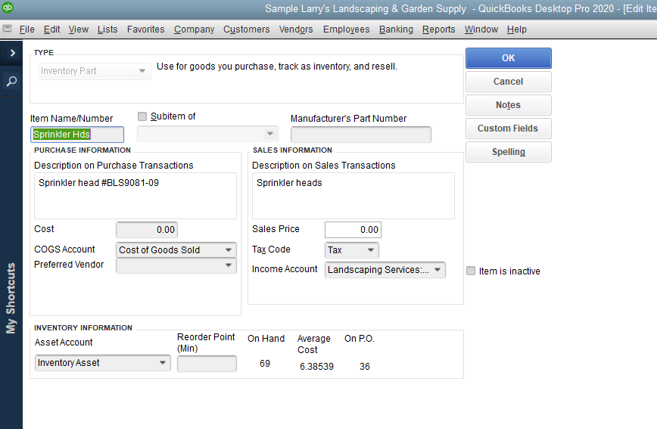

1. AccountEdge Pro

AccountEdge Pro has the honor of being our top-rated accounting application and with good reason.

A good fit for small and growing businesses, AccountEdge Pro is an on-premise application that also offers the convenience of remote access, taking you easily through the entire accounting cycle.

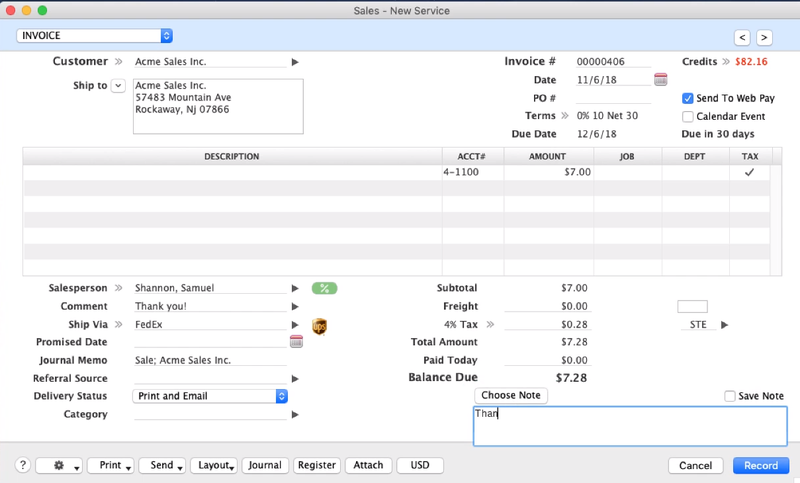

2. FreshBooks

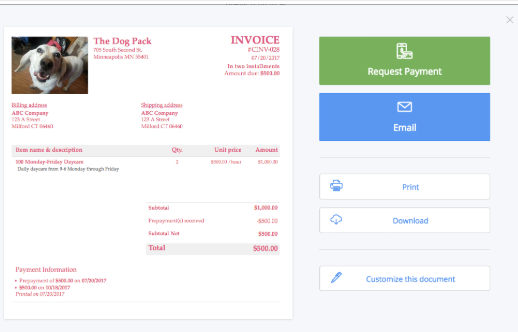

FreshBooks is an online accounting software application that works well for sole proprietors and freelancers.

The Retainers feature in FreshBooks also makes it ideal for attorneys, accountants, or any professional that charges their clients a retainer fee.

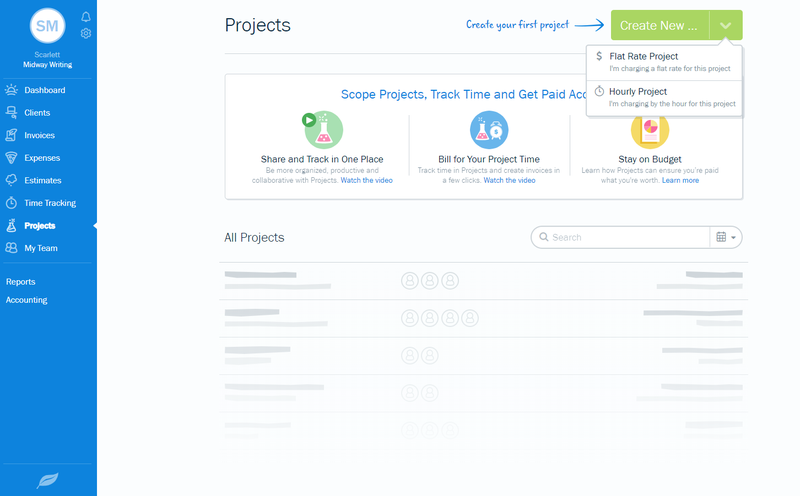

3. Sage 50cloud Accounting

Previously known as Peachtree Software, Sage 50cloud Accounting is a hybrid solution that is installed on-premise, but also includes an option to connect to the application remotely if necessary.

Sage 50cloud Accounting is a good choice for small and growing businesses, with multiple plans available. Sage 50cloud Accounting includes a solid inventory module and offers integration with multiple point-of-sale (POS) applications, which makes it particularly suitable for retailers.

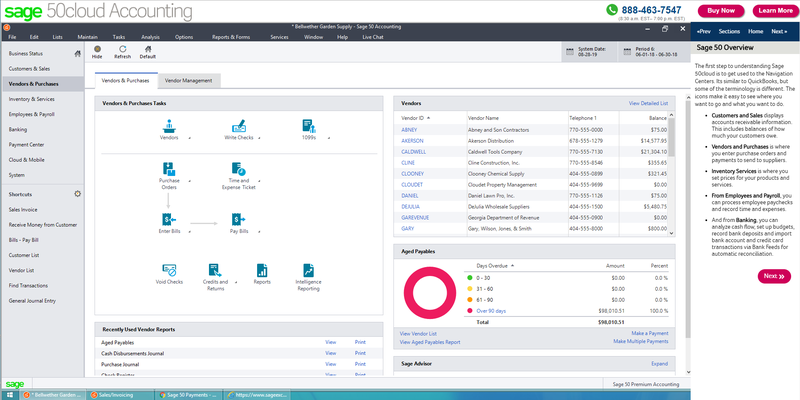

4. QuickBooks Desktop

QuickBooks Desktop 2020 includes several new features that are designed to streamline various processes. These new features include:

- Enhanced system navigation

- Expanded help capability

- Automatic payment reminders sent to past due customers

- Ability to consolidate invoices into a single email

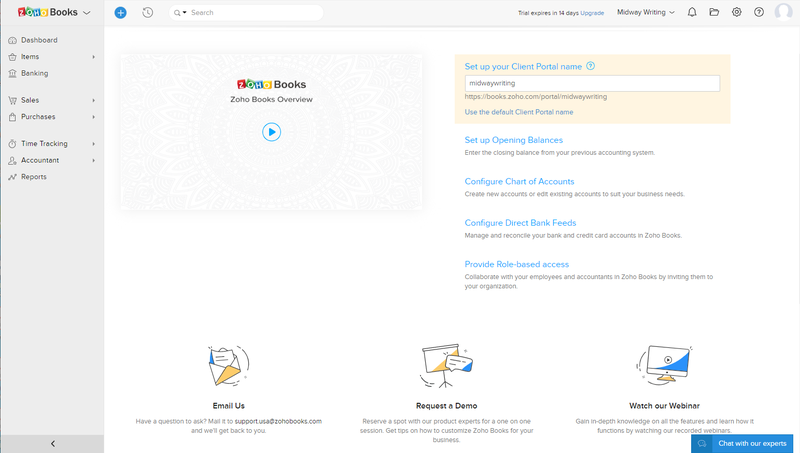

5. Zoho Books

If you’re a sole proprietor, freelancer, or starting a brand new business, Zoho Books is for you.

Affordable for even the tightest budget, Zoho Books includes a solid inventory management feature and provides new users with step-by-step directions for everything from general setup to writing an invoice, making it easy to get your new business set up and running quickly.

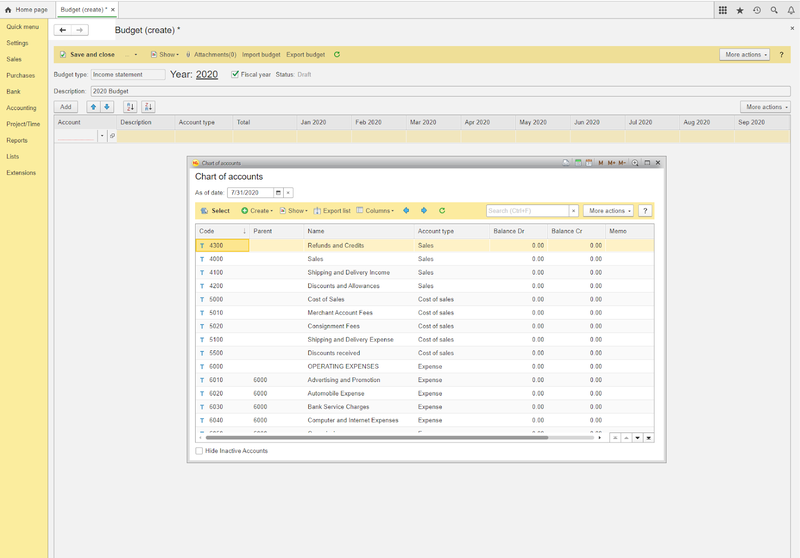

6. AccountingSuite

AccountingSuite offers the features that small businesses have come to expect from any software application, including cloud accessibility and solid accounting capability. Bank connectivity is also offered in AccountingSuite, with the application able to connect to over 9,000 financial institutions.

You can manage your invoicing in the Sales module, and process and pay bills in the Purchases module. Both project and time tracking capability are offered in the application as well, so you can track projects and profitability, while the time-tracking feature allows you to record the time spent on each individual project.

7. OneUp

OneUp is the best small business accounting application you’ve probably never heard of. Ideal for sole proprietors and freelancers, with its robust inventory management module, OneUp is a great option for retail businesses.

OneUp is also suitable for growing businesses, with pricing based solely on number of users rather than features, with the Self plan, for a single user, including the same features as the Unlimited plan.

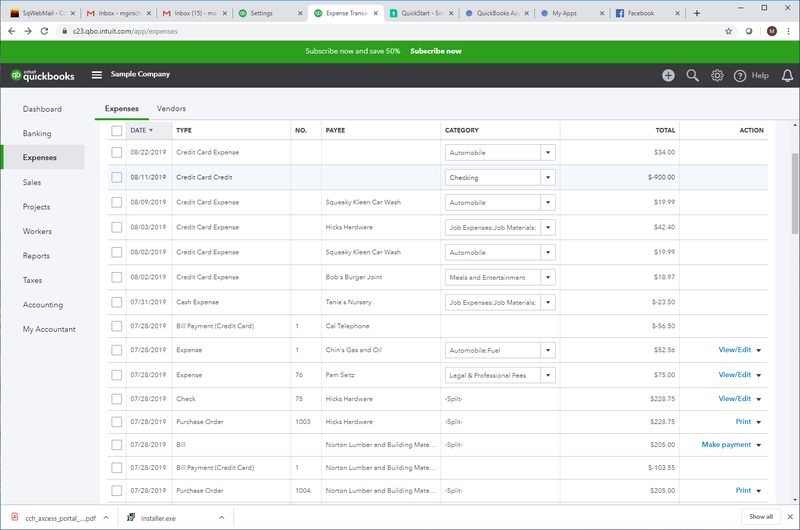

8. QuickBooks Online

QuickBooks Online is perhaps the most recognized of all of the small business accounting applications. Designed exclusively for small businesses, QuickBooks Online offers easy anytime/anywhere access that was lacking in their more robust desktop version.

A good fit for small and growing businesses, QuickBooks Online is often compared to FreshBooks. It integrates with hundreds of third-party applications, making the application suitable for all types of businesses.

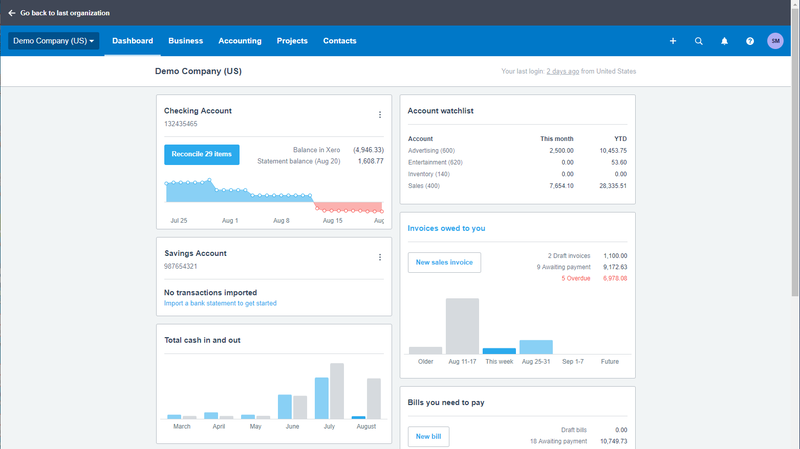

9. Xero

Xero is an online accounting software that offers the convenience of running your business from anywhere. It’s designed for the small business owner who doesn’t want to spend a lot of time learning accounting but wants to stay on top of business performance. Xero works great for a variety of niche markets, including retail, IT, legal, e-commerce, and startups, and its ability to deal with multiple currencies makes it a good fit if you conduct business globally.

Xero offers double-entry accounting, with a default chart of accounts that can be customized if needed included in the application. Recurring journal entries are available in the application, and you can easily connect your bank accounts to Xero for automatic import of all bank transactions.

10. Sage Business Cloud Accounting

Ideal for sole proprietors and freelancers, Sage Business Cloud Accounting also includes solid inventory management, making it a good option for retailers, particularly online sellers.

There is no payroll feature available in Sage Business Cloud Accounting, nor in the third-party apps the application integrates with, so it’s probably not the best choice for your business if you have employees to pay.

Conclusion

Let us know your thoughts in the comment section below.

Check out other publications to gain access to more digital resources if you are just starting out with Flux Resource.

Also contact us today to optimize your business(s)/Brand(s) for Search Engines