You are looking for the best apps for money advance. But firsly, what is a money advance? A money advance means when you get an instant loan from a company. Tight budget is a problem that everyone has to face. But sometimes it can be an opportunity for us to make some quick cash by getting money on loans that we need to pay back with reasonable interest. This article will provides some of the best apps out there that can help you get quick loans right away.

Table of Contents

Best Apps For Money Advance

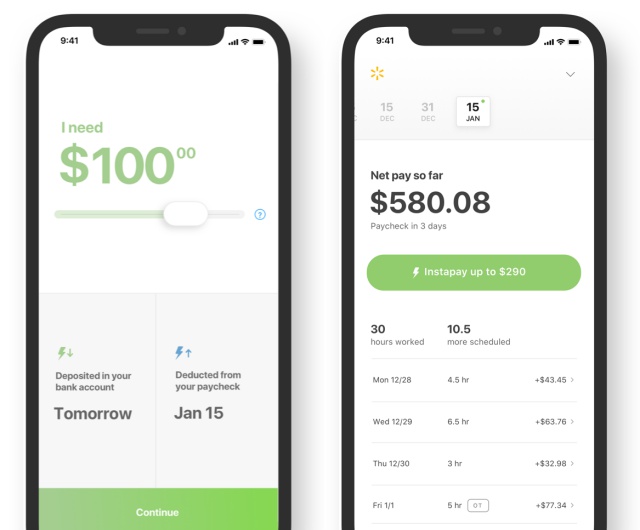

- Earnin – Best for hourly workers

Earnin is an app that allows you to borrow against your next paycheck quickly without any fees or interest payments attached.

When users sign up for the app, Earnin connects their bank accounts to verify their payment schedules. The app calculates users’ hours by tracking how long they’re at work using their phone’s GPS or by allowing them to submit a timesheet. It then determines hourly pay rate based on how much money the user receives in direct deposit.

Earnin allows you to withdraw wages that haven’t been paid for by employers yet. When the next paycheck hits your bank account, Earnin automatically debits your account for the amount that was borrowed.

Initially, users can only withdraw up to $100 each pay period. The maximum amount that can be withdrawn is $500 but only after users establish a record of app use and repayment.

There is no fee attached to the service. Earnin makes money from voluntary tips from its users.

Costs: voluntary tips

Max advance: $100 to $500

- Dave – Best for overdraft protection

If overdraft fees are cutting into your budget, Dave can help. Dave’s app looks for potential overdrafts, like an upcoming bill, and alerts users before their accounts are overdrawn. The app also provides a Yours to Spend summary, a personalized budget that factors in income and past expenses to estimate how much users can spend freely.

If you don’t have the funds available for an upcoming expense, Dave can lend a small advance. It determines the max advance amount based on how much you’re able to pay back on the next payday. Users are expected to repay the interest-free advance as soon as their next paycheck is deposited.

Additionally, Dave can guide users to find a side hustle in the gig economy. A side hustle is a job taken on in addition to a main job, and it may have more flexible hours and pay. It can help eliminate the need to take out a short-term loan at all by providing supplemental income in between paychecks.

Dave membership costs $1 a month, but there’s the option to send a tip for users who want to show more support for the service. Dave also has a spending account users can sign up for, which comes with a feature that allows paychecks to deposit into your account up to two days early.

Costs: $1 a month plus voluntary tips

Max advance: $250

- Brigit – Best features

Brigit is another app that helps with budget management and offers cash advances to stretch funds between paychecks.

To get an advance, Brigit needs to connect to a user’s checking account that has an active history for at least 60 days. Additionally, the checking account must have a positive balance and a record of at least three direct payroll deposits. Assessments of your bank account and spending history factor into a Brigit score, which the app uses to determine whether you qualify for instant cash. Users may qualify for up to $250 in cash advances. Brigit then sets a due date for the loan’s repayment.

Users who qualify for instant cash through Brigit also have the option to turn on an automatic transfer feature that sends an advance to the user’s bank account when they’re at risk of an overdraft. Plus, like the Dave app, Brigit can help you find a side hustle to bring in extra income when you need it.

The basic membership to Brigit is free but doesn’t include access to cash advances. That service requires upgrading to Brigit Plus for $9.99 a month, which includes several other features to boost users’ financial health, including a credit builder, identity theft protection and repayment extensions that allow users to reschedule their due dates.

Costs: $9.99 a month to access the cash advance feature

Max advance: $250

- Current – Best for spending

Current is a checking account available only through a mobile app. The app’s goal is to help consumers spend less money on fees and find ways to budget more effectively.

Current offers a free version of its account, but to access most features, including overdraft coverage, you’ll need to pay $4.99 a month for a Premium account. With a premium account, direct deposits transfer to your account up to two days sooner and overdrafts are covered with no fee — up to $25 in overdrafts for new account holders, with the ability to increase that limit to $200 over time. Current also instantly releases pre-authorized holds on purchases with variable amounts, such as gas stations, that typically place a hold on your account for up to 10 days. Current releases the hold, sending the funds back to your account.

At the time this article was updated, Current also offered a $50 bonus when new members sign up for Premium.

Costs: $4.99 a month for Premium

Max advance: $25 to $200 in overdraft protection

- Chime – Best for those tired of bank fees

Chime is an app that is associated with Chime’s Checking Account. With the Chime app, users can receive directly deposited paychecks up to two days early. The app sends alerts for any new transaction to help users keep track of spending and detect any unauthorized expenses. In the case that a user loses their debit card or notices a suspicious transaction, they can immediately disable the debit card from the app.

Chime comes with the SpotMe service, which allows account holders to overdraw their accounts up to $200. The limit for new users, however, is $20. Chime deducts the overdraft amount from the user’s next paycheck, helping users cover expenses without having to worry about overdraft fees.

Chime accounts are free to use. Instead of imposing bank fees on its customers, Chime earns money from fees charged to merchants for each debit-card transaction.

Costs: none

Max advance: $20 to $200 in overdraft protection

- MoneyLion – Best for those who receive direct deposits

MoneyLion is another option that comes with interest-free cash loans and expedited direct deposits to help users cover expenses in between paychecks.

Its Instacash service provides interest-free cash advances to help cover unexpected expenses to users with recurring direct deposits. Up to $25 in cash advances is available at first, but eligible users may qualify for up to $250.

There are no required fees attached to a MoneyLion account. Users may pay an optional fee for expediting transfers from Instacash.

MoneyLion also offers an online account called RoarMoney, which is required to receive faster direct deposits and unlock the highest amounts for cash advances. There’s a $1 monthly fee for a RoarMoney account.

Costs: $1 a month to unlock the highest cash advance amounts

Max advance: $25 to $250

Pros and cons of using a cash advance app

Though cash advance apps can help to cover emergency expenses, there are also some risks to consider that come with using them.

Pros of cash advance apps:

Consumers can conveniently access funds to cover emergency expenses ahead of the next paycheck.

Cash advance apps come at a much lower price — or none at all — than payday loans.

Some of the apps come with helpful budgeting tools, like Dave’s Yours to Spend feature.

With a cash advance app, you can more easily avoid overdraft fees by funding your account before it is overdrawn. Several of the apps even automatically cover overdrafts.

Best apps to get an advance

- Earnin: Best for low fees

Earnin is a paycheck advance app that tracks your hours worked — using either a timesheet or by tracking your location — and lets you borrow money you’ve earned. The app also has a feature that notifies you when your bank account balance is low and a feature that will top it off for a fee.

» READ MORE: NerdWallet’s Earnin review

Amount: $100 to $500.

Fees: Earnin asks for a voluntary tip, which is capped at $14. You can opt into the overdraft protection feature automatically by setting a recurring tip of at least $1.50.

Speed: You can sign up for Earnin’s Lightning Speed feature, which gets you the money instantly. Otherwise, it typically takes one or two business days.

Repayment: Earnin withdraws the cash you borrowed from your bank account on your next payday.

APR example: If you borrow $100 seven days before payday and tip $2, your loan’s APR is 104.3%.

- Dave: Best for small advances

The Dave app lets you borrow a small amount of money to cover expenses while you wait for your next paycheck, or to avoid overdrawing your bank account. Users who have a Dave spending account have access to larger loan amounts than those who don’t. The app also has a “Side Hustle” feature that helps users find side gigs to earn more money.

» READ MORE: NerdWallet’s Dave app review

Amount: $5 to $200 for Dave spending account users; $5 to $100 for customers without a Dave spending account.

Fees: Dave charges a few fees, but the company says they’re all optional:

$1 monthly subscription fee, which you can opt out of in the app.

$1.99 to $5.99 fee to get your money faster. The fee varies based on loan amount.

Optional tip up to 20% of the amount borrowed.

Speed: It takes up to three days to get your money from Dave. If you pay the express fee to get your money faster, the company says you’ll get your funds within eight hours.

Repayment: Your payment date is set to your next payday by default, but you can change it.

APR example: If you borrow $100 seven days before you get your next paycheck, pay a $5.99 express fee, the monthly $1 subscription fee and add a $1 tip, it’ll cost $7.99 to borrow the $100. The APR on that loan would be above 400%.

Track your spending — for free

NerdWallet’s free app helps you track your spending, find ways to save and build your credit score.

- Brigit: Best for budgeting tools

Brigit is a budgeting app that can get you up to $250 whenever you need it. You can use the app’s free plan, which offers financial advice and budgeting help. To get the cash advance, you have to use the paid plan, which includes all the features of the free plan, plus cash advances, automatic deposits in your account if you’re about to overdraft and credit monitoring.

» READ MORE: NerdWallet’s Brigit app review

Amount: $50 to $250.

Fees: The paid plan is $9.99 per month.

Speed: Brigit says it can get you an advance the same day if you request it before 10 a.m. ET; otherwise, it will arrive the following business day.

Repayment: Brigit automatically sets your next payment according to your income schedule. You can extend your repayment date in the app, but only one time for every two advances you pay back on time.

APR example: If you get a $9.99 Brigit membership and use the app only to get a one-time, $100 advance that you’ll repay in seven days, your loan has an APR of over 500%.

- Chime: Best for existing customer overdraft protection

Chime, a mobile company that offers checking and savings accounts, as well as credit-builder loans, lets customers overdraw their checking account by a small, predetermined amount without fees via its SpotMe feature. SpotMe is more of an overdraft protection feature than a cash advance, but it still asks if you want to tip for the service. Chime says your account can go negative up to your approved amount, and purchases that put you below that extra cushion will be declined. You need at least $200 in qualifying direct deposits to your Chime account every month to qualify for SpotMe.

Amount: $20 to $200. Limits start at $20 and increase based on your account activity.

Fees: There are no fees. The company asks if you want to tip.

Speed: Instant. You set up SpotMe before you overdraw, and then it’s built into your account moving forward.

Repayment: Your next direct deposit — typically on your next payday — will repay the amount Chime spotted you.

APR example: If Chime gives you $50 to overdraw, you repay the balance in seven days and add a $1 tip, you’re basically getting a $50 loan with a 104.3% APR.

- MoneyLion: Best for multiple financial products

The MoneyLion app offers mobile bank and investment accounts, financial tracking, a credit-builder loan and cash advances up to $250. The Instacash advance is available to anyone with a qualifying checking account. However, you’ll have to pay a fee if you don’t have a MoneyLion account and need your funds quickly. MoneyLion says it charges no interest or fees with the cash advance, but you’re asked to provide an optional tip if you get an advance.

» READ MORE: NerdWallet’s MoneyLion Instacash review

Amount: $25 to $250, but only MoneyLion checking account customers get access to the largest amounts.

Fees: MoneyLion has an optional tip, plus a fee for instant delivery:

MoneyLion checking account users: $3.99 for instant delivery.

Users with non-MoneyLion checking accounts: $4.99 for instant delivery.

Speed: If you don’t pay the instant delivery fee, it takes 12 to 48 hours for MoneyLion checking account users, and three to five business days for non-MoneyLion checking account users.

Repayment: The funds are automatically withdrawn from your account on the day you’re expected to receive your next deposit — typically your next payday. If your account doesn’t have enough money, the app will repeatedly try to withdraw the funds. If your payment is more than five days late, you’ll be charged a late fee.

APR: If you get a $100 advance deposited instantly into an external account for $4.99, add a tip of $1 and repay the loan in seven days, you’ll be charged an APR of over 300%.

Conclusion

Let us know your thoughts in the comment section below.

Check out other publications to gain access to more digital resources if you are just starting out with Flux Resource.

Also contact us today to optimize your business(s)/Brand(s) for Search Engines