Financial services companies are always looking for new ways to reach their audience. Social media marketing is a great way to engage your customers and build brand loyalty, but it can be difficult to keep up with all the changes in the industry. Here are some of the latest social media tools that financial services companies should try.

Table of Contents

Social Media Tools For Financial Services

Banks, payment and insurance companies need to appeal to all types of customers.

Part of this implies having a failproof digital marketing strategy, especially on social media.

Like it or not, social media isn’t just for chatting with friends anymore. People use it to talk with the brands and companies they use.

For instance, 80% of Instagram active users say they follow brands on the platform.

Social media has become a double-edged sword.

For brands, it’s a premium channel to reach out and share valuable information. On the other hand, it opens a new public complaints channel.

Eventually, this means that claiming a “social media presence” through a Facebook page doesn’t cut it.

Instead, financial services companies need to be aware of all key conversations, be available to answer customers and stay connected round-the-clock, no matter what.

They cannot afford to make compromises when it comes to customer experience and satisfaction levels. They need to earn and keep the trust customers place in their brand and services.

This is where social listening comes in pretty handy.

What is social listening and why is it crucial for the financial services industry?

Social listening shows you what’s being said about your brand, competition, and market on major social media platforms such as Facebook, Twitter or Instagram, as it happens, without you having to go and look for it.

In short, it lets you:

- Know what’s said about your brand and services as soon as it’s live.

- Track social media mentions on key social networks.

- Identify key market trends before they go mainstream.

- Identify and solve crises before they happen.

- Analyze the metrics that are of value to you and your company.

- Share personalized performance reports with clients and stakeholders.

At the end of the day, a social listening tool can help demystify the noise generated every day on the internet for marketing and communication professionals.

After all, there are billions of conversations happening each day online, and there’s no way humans can keep up. Not without the help of technology.

All in all, listening lets you track all these messages to find the ones that matter to you and your institution.

1. Track all relevant conversations, from one tool

Whether you’re a global institution, a small business, or a pure player – listening is essential – for all financial institutions.

Now, it’s true that you could go from platform to platform looking for mentions of your institution’s name and services.

But there are two big flaws to this strategy.

- It’s a huge timesuck: If you get mentioned in hundreds, or even thousands of times a day – you’ll need to find time to filter the noise to see conversations that really matter.

- You will miss important things: It’s impossible to know everything that is being said about your brand. You can’t know all that’s said about your brand. Not without help. There are too many sources, too many customers, and simply too many voices out there. And some of the mentions you’d miss could end up being complaints from valued customers, or even endorsements from powerful influencers. Too bad.

2. Identify your market’s trends and innovations

Financial institutions are driving innovation.

This means that they often invest heavily in innovative projects and technology.

This is the visible part of the iceberg.

What financial institutions need to do, at first, is to identify key innovations to integrate to their ecosystem, to inspire the market, build and maintain trust.

Well, nowadays, inspiration often starts with the ability to deliver a pain-free customer experience.

For financial institutions, this also means mastering the latest technologies to guarantee a safe service.

This is a challenge that brick and mortar institutions face today when younger, innovative pure players completely disrupt the established industry.

Using a listening tool, you could stay on top of trends and topics that matter to you and your target audience.

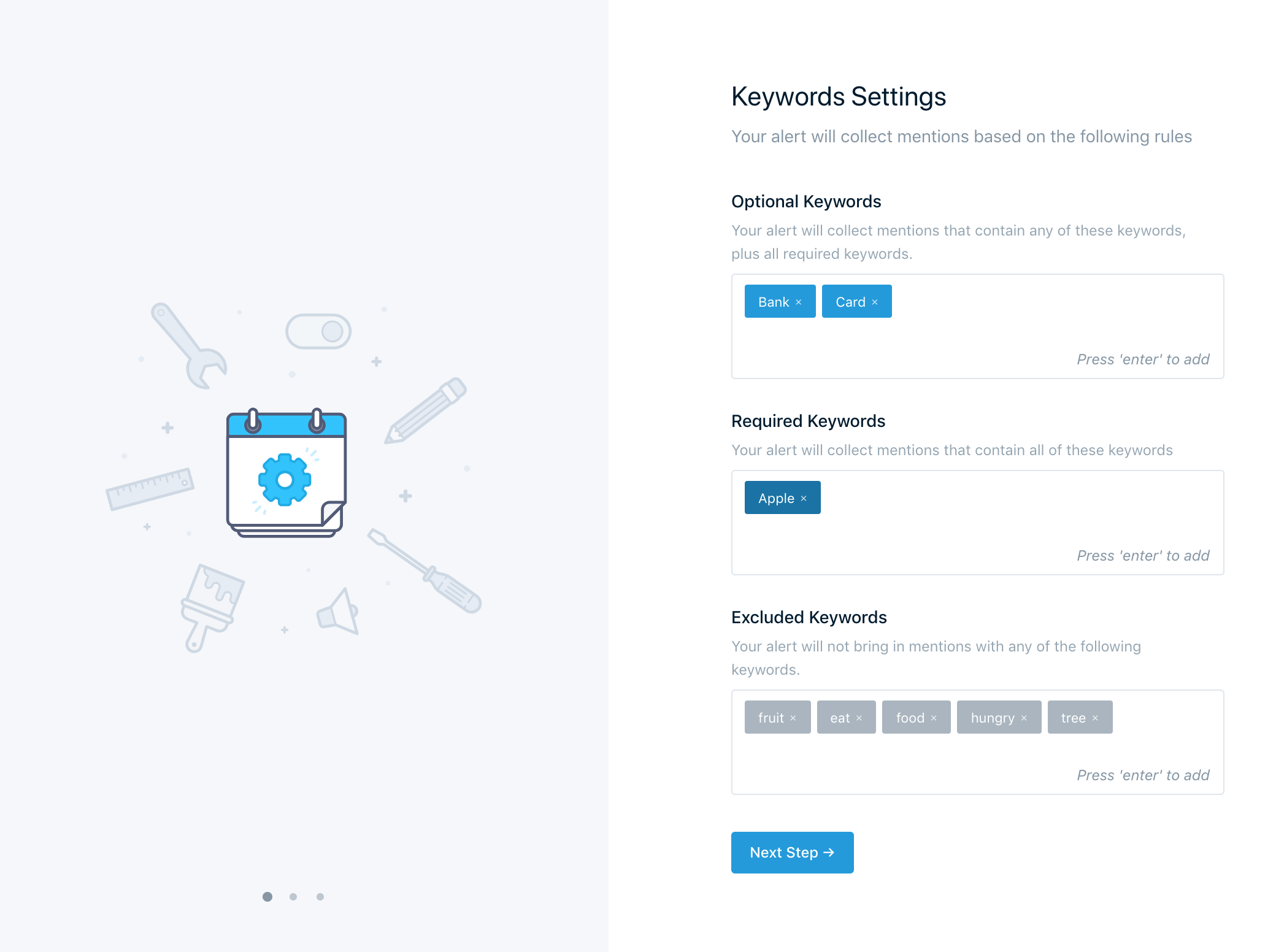

Here’s an example of an alert you could set up to keep an eye on the latest cybersecurity and data breach trends. To some extent, this could give you a significant advantage over your competition.

3. Identify (and measure) brand awareness opportunities before your competition does

Sponsoring events is one of the best ways to generate awareness around a brand, especially for FinTech brands.

Now, you need to make sure that you’re investing your money in the right events, targeting the right audiences.

One way to do it is to target those that your competitors have already sponsored in the past. Another way to do it is to measure the impact of events that could be of interest to you and analyze their online impact.

Do they resonate with your values? Are they targeted at your core audience?

With a listening tool, you’ll also be able to identify key events before your competition does, giving you a heads up to reach out and establish a relationship with the organizers

4. Keep your customers happy during an unstable time for banks

Over the last couple of years, we’ve noticed an important market shift within the banking industry.

Loyalty towards institutions is not as strong as it used to be and banks are losing millions of clients.

What’s more, a Bain & Company global survey (of 137,034 consumers in 21 countries) says that 29% of consumers would change their bank if it were easy to do so.

Having an established listening strategy could help most institutions to identify pain points and iterate on them before they turn into a reason to churn.

Ultimately, your clients and users want to know that you listen to them and are available as soon as a problem arises.

The good news is that advanced tools will alert you immediately when new messages populate your inbox.

“With Mention, Spike alerts tell you when there’s a sudden spike in mentions so that you can react as soon as you possibly can.”

–Delphine Le Person, Customer Success, Mention.

It’s a no-brainer, but you need to care about what buyers think of your products and services. And you’ve probably noticed that people tend to share their thoughts about everything on social media.

While this can be frustrating, social media is a great place to get honest feedback about your services.

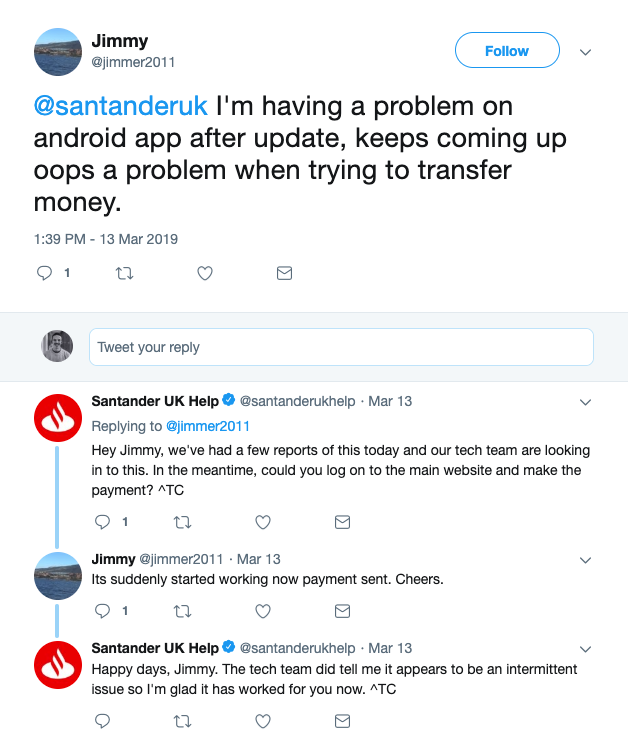

Here’s an example of this with @WellsFargo.

It’s not positive, but it’s constructive feedback, telling WF they need to invest in customer service. It will be tough at times, but you’ll learn a lot about your own business.

5. Provide a premium customer service

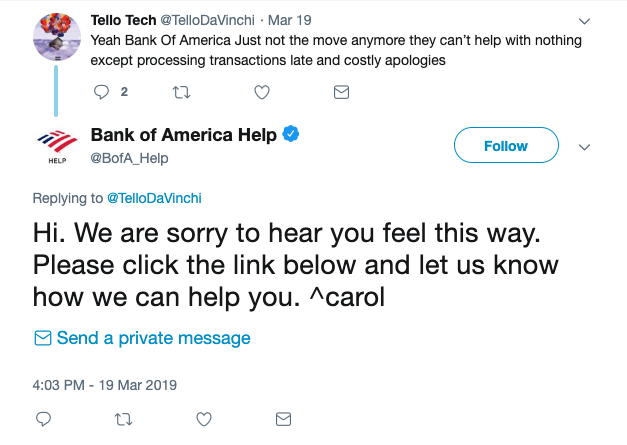

When it comes to social media for financial services, customer support is vital.

Now, it’s far from being easy.

In fact, a challenge that brands of all types currently face is the digitization of customer service. Here are some ways social listening can help:

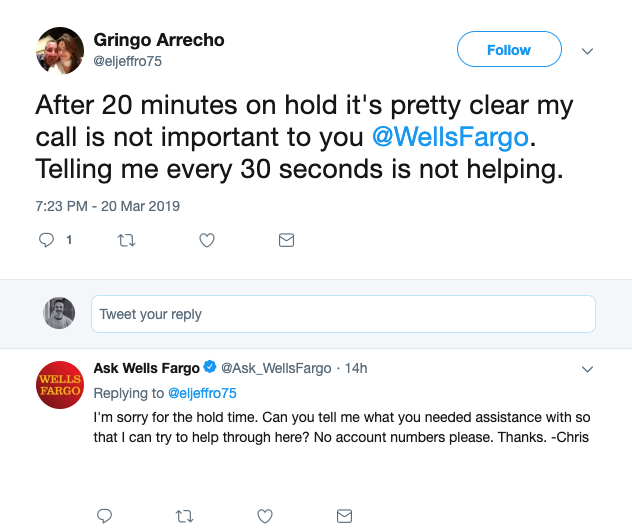

1. Your brand is directly @mentioned online.

2. Your brand is not directly mentioned.

Chances are that, just like Bank of America, there are whole conversations taking place on social media about your brand, with nobody tagging you directly.

Are you able to identify posts like these today?

In some situations, people will talk about you in conversations that have little value for your brand.

In other cases, they will talk about you and need help with something. By identifying these messages and acting quickly on it, you will turn angry customers into loyal customers and therefore increase your retention rate.

Not only this will keep your customers happy, but it will also humanize your brand and build trust between you and your target audience.

6. Prevent crises before they happen

Social media is a fast-moving, high-intensity space. It’s where things “go viral”. For this reason, financial institutions need to watch carefully for negative press.

In theory, rogue employees or unhappy clients can post anything they like online to try and hurt your brand. And if their messages gain traction, you’ve gone from one person saying bad things, to thousands.

What’s more, a brand crisis will always sneak up on you when you least expect it. And if it does, you’ll be glad — if you’re given the chance — that you caught it early and had a chance to limit the damage.

That’s why social listening needs to be part of any crisis management plan.

—

Do you want to get more insight to strengthen your social media marketing strategy? 🧐

Download our Guide to Social Media Management for Financial Institutions.

In this comprehensive guide, you’ll learn:

- What to do once you’re on social media

- What type of social media content to publish

- How to use social media for crisis management

- How to benefit from influencer marketing

- How to deal with customers reviews

- How to leverage social media for competitive analysis

- How to boost your employer branding using social media.

- As well as how successful financial brands manage their social media accounts.

social media in the finance industry

The use of social media in financial services was important even before 2020. Then the pandemic vastly shifted how we maintain relationships with clients and customers. Now, social media is non-negotiable.

Social media has changed the nature of client relationships during the pandemic for 90% of financial advisors. More than half of those who brought in new business increased their use of social media this year.

That said, there can be plenty of challenges to using social media in a regulated industry. Here’s how to develop a social media strategy for financial services in 2021.

Bonus: Get the free social selling guide for financial services. Learn how to generate and nurture leads and win business using social media.

The use of social media in financial services: 6 key benefits

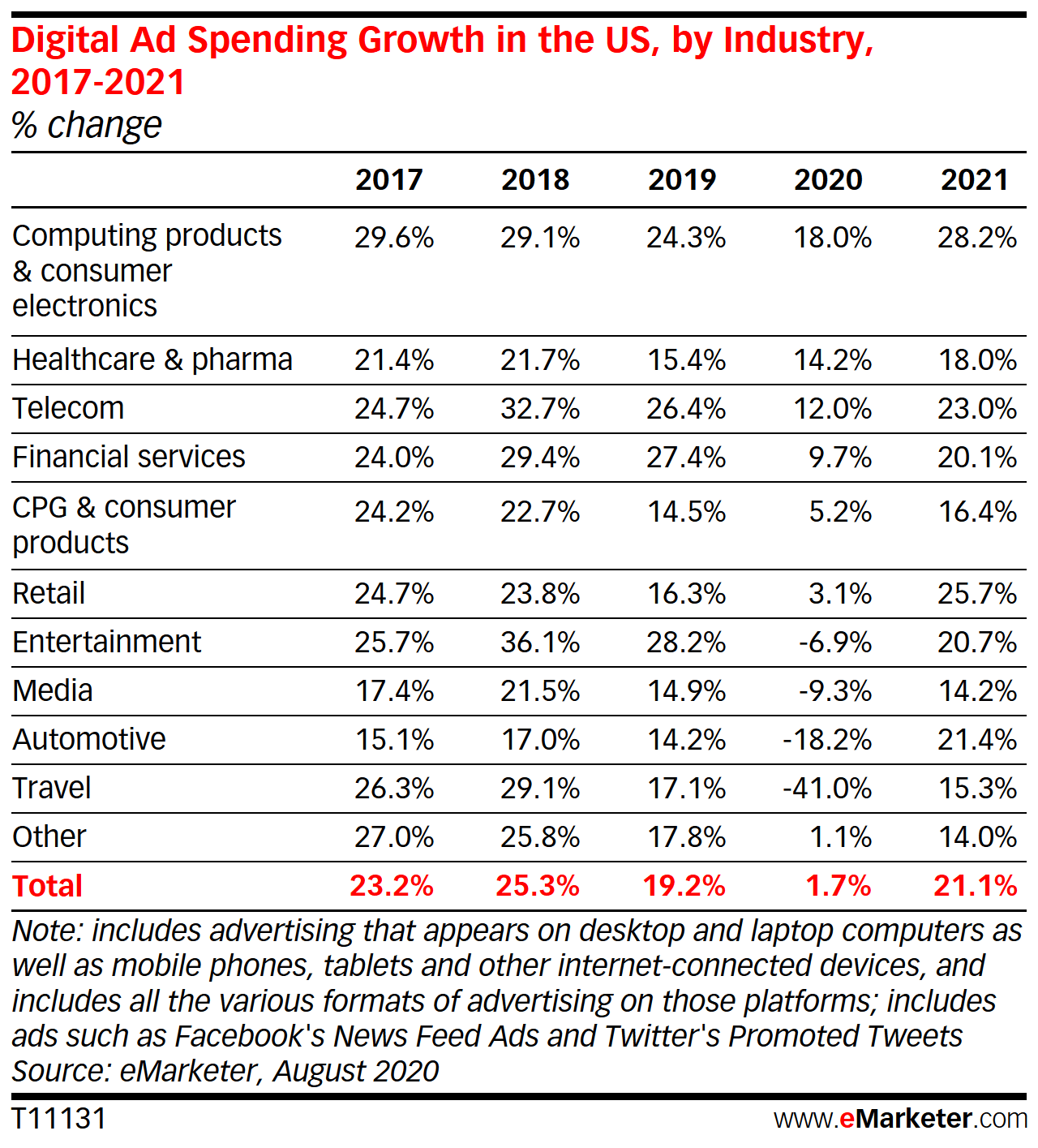

Many industries slashed their digital ad spending in the wake of COVID-19. But financial services companies increased their digital ad spend by 9.7%. That brought it to $19.62 billion. Only the retail industry spent more.

Source: eMarketer

Organic social media will also become increasingly important to finserv brands. Generation Z is starting to consume more financial services. At the same time, our Digital 2020 data shows Baby Boomers are embracing both social media and mobile payments like never before.

Financial services brands need to meet both of these generations—and all those in between—on the digital platforms they use every day.

Let’s take a look at some of the most important benefits of social media in financial services.

1. Strengthen relationships

Building relationships is a key use of social media for finance industry professionals. When it comes to money, everyone wants to deal with someone they know and trust.

Especially when you can’t meet your clients in person, social media can help you build that trust. It helps maintain customer relationships you would normally build at your office or branch.

69% of respondents to the Hootsuite Social Transformation Report said social helped them get through the pandemic by allowing them to maintain customer and audience relationships.

In a Putnam Investments survey, 74% of advisors said they used direct messaging on social networks to communicate with clients and prospects. Almost all of them (94%) reported gaining new assets.

Nurturing prospects and clients online is known as social selling. Here’s a quick primer on how it works:

Social media can help identify important financial moments in your clients’ and prospects’ lives. For example, LinkedIn is a great place to learn about career changes or retirements. Following clients’ business pages can also give you insight into their challenges.

One regional broker-dealer advisor told Putnam he learned about an issue through a client’s Facebook Page. He contacted her through Messenger to resolve it. Then, she sent him several referrals.

That said, social selling is usually about building relationships that lead to sales in the long term. When one of your connections gets a new job or launches a new business, by all means send a congratulations message. Keep yourself top of mind. But don’t jump in and try to make a sale.

It’s important to focus on providing trustworthy information and resources. Particularly when people are struggling. Prioritize the client’s needs over making the sale.

2. Highlight brand purpose and build community trust

84% of respondents to a special Edelman Trust Barometer report said they expected or hoped brands would use social channels to “facilitate a sense of community and offer social support.”

60% of respondents to Deloitte’s annual survey of millennials and Gen Z said they will buy more from “large businesses that have taken care of their workforces and positively affected society during the pandemic.”

And in Brandwatch data, more than three-quarters of consumers say it’s important that brands proactively make the world a better place.

As we note in our Social Trends 2021 Report, brand purpose has to come from company leaders, not just the marketing department. Look for ways you or your company can support your community. For financial services firms, an easy win is to support small and local businesses.

Howard Bank, based in Baltimore, launched a campaign called “Keep It Local.” The idea was to support local businesses by highlighting them on social media and other channels.

To put their money where their mouth was, the campaign also incorporated a contest. One winning local business received a grant of $10,000, and the runners-up received $1,000.

Even after the contest, Howard Bank continues to highlight small local businesses on their social channels. They have credibility as supporters of local business over the long term.

3. Humanize your brand

People want to deal with trusted financial experts. That doesn’t mean they want their financial services providers to be clinical and cold. Social media provides a great opportunity for you to humanize your brand.

Getting your company’s executives on social media can be a great place to start. After all, it can be easier to trust a person rather than an institution.

C-level executives don’t have to stick to dry financial topics. Encourage them to show a bit of personality.

When Town and Country Bank in Ravenna, Nebraska, upgraded its digital services, more than 1,300 users had to download a new mobile app. They also had to re-subscribe for email statements, and re-establish their digital credentials.

Presenting this in a simple list of required steps might have elicited eyerolls, annoyance, or even panic from clients. Instead, the bank created a fun Facebook video featuring its former president and his wife, who are well known in the community.

Putting a human face on the brand was key in getting people to understand the importance of the upgrade and the required actions. The digital platform changed on July 13. By the end of July all but 100 customers had taken the required steps.

And the video reached far beyond the target audience, reaching 34,000 views and eliciting a positive response from the community.

Depending on your audience and the channels you use, you can have a lot of fun using social media in finance: 2021 is the time to get creative.

LinkedIn is by far the most used social network for financial services, but less formal platforms are gaining popularity, too. Consider that 31% of advisors now use Snapchat.

And the Swiss bank PostFinance uses TikTok to connect with its young audience. It’s clear the staff get a kick out of the process.

https://www.tiktok.com/embed/v2/6900951230969941250?lang=en-US&referrer=https%3A%2F%2Fblog.hootsuite.com%2Fsocial-media-financial-services%2F

4. Gain key industry and customer insights

Try using social media for financial services industry research. This is a good way to stay on top of what’s happening in your field.

Whether it’s a competitor’s latest product offering or an impending PR disaster, think of social media as an early warning system.

With social media listening, you can learn what’s happening with your competitors and your industry.

Here’s how it works:

You can also use social listening to learn about your customers and gauge what they want from you. As pointed out in our Social Trends 2021 Report, it will be important in the coming year for brands to “prioritize listening over talking.”

Through social listening, Securian Financial found its most important demographics were not complaining about quarantine. Instead, they were sharing stories about how they were staying connected.

Securian then created a user-generated content campaign. They used the hashtag #LifeBalanceRemix to encourage people to share these stories. There was heart behind this campaign, too. They donated $10 to Feeding America for every user who posted with the hashtag or shared the campaign.

The result was more than 2.5 million impressions and an estimated ROI of $35,000.

Also be sure to keep an eye on your social media analytics. These tools give you insights into the effectiveness of your own social efforts. You can learn what works best and refine your social media marketing strategy for financial service customers as you go.

5. Reduce effort and costs

Social efforts work best when teams, departments, and individual advisors use social media in a coordinated way. Most likely, this involves a shared social media management platform.

In the Putnam survey, nearly 90% of advisors said support from their firms made a positive difference in their use of social media. Specific areas of support advisors mentioned include:

- Providing content to post

- Providing support resources

- Offering training

A content library is a valuable resource for both employees and brands. Staff has access to pre-approved, compliant content that’s ready to go. Brands have peace of mind when employees post consistent messaging that supports strategic goals.

And all of it is housed in one central library, so there’s no duplication of effort or expense.

Bonus: Get the free social selling guide for financial services. Learn how to generate and nurture leads and win business using social media.Get the free guide right now!

The American Bankers Association recently launched a campaign to highlight phishing concerns. They created a set of resources all banks could use. That includes social posts, videos, and GIFs using the hashtag #BanksNeverAskThat.

Banks then shared the resources across their social channels. They were able to educate their clients on this important subject without much effort or investment.

Here’s how it looks in action on the social platforms of several banks:

e chat is clients’ second-most preferred option for customer service. It’s outranked only by telephone support. For those under 25, social media is the top choice for customer support.

But Gartner found financial services companies are lagging behind in offering chat support. Only 35% of retail banking companies, 31% of insurance companies, and 9% of wealth and asset management companies offer website live chat.

Online messaging through social channels can be a good alternative to setting up chat functionality on your own site.

When Citizens Bank launched an update to their mobile banking app, things went sideways. Basic functionality was broken, and customers were not happy. They flooded the Citizens Bank social channels with complaints and requests for help.

Citizens Bank has a dedicated customer service Twitter account. They also have the Messenger pop-up enabled on their Facebook Page. This allowed them to respond to clients on the platforms where they already spend their time.

Their ability to respond on social media likely mitigated some of the damage from the app update glitch. They’d have had even more success if they had been able to respond faster.

Gartner notes retail banks that get high marks for customer service reply within an hour. They also have preset questions and automatic responses to deal with common requests. (Remember what we said about reducing effort?)

Speaking of reducing effort, when it comes to providing customer support on social, a tool like Hootsuite Inbox can help you manage conversations from all your channels in one place. You can also create “Saved Replies” for frequently asked questions, view your entire conversation history,and assign messages to your team members, while tracking response times.

Conclusion

Let us know your thoughts in the comment section below.

Check out other publications to gain access to more digital resources if you are just starting out with Flux Resource.

Also contact us today to optimize your business(s)/Brand(s) for Search Engines